what is doordash considered on taxes

DoorDash is a 1099 job. The IRS views any money you gain as income so if you were a regular employee your taxes would be calculated based on your gross hourly.

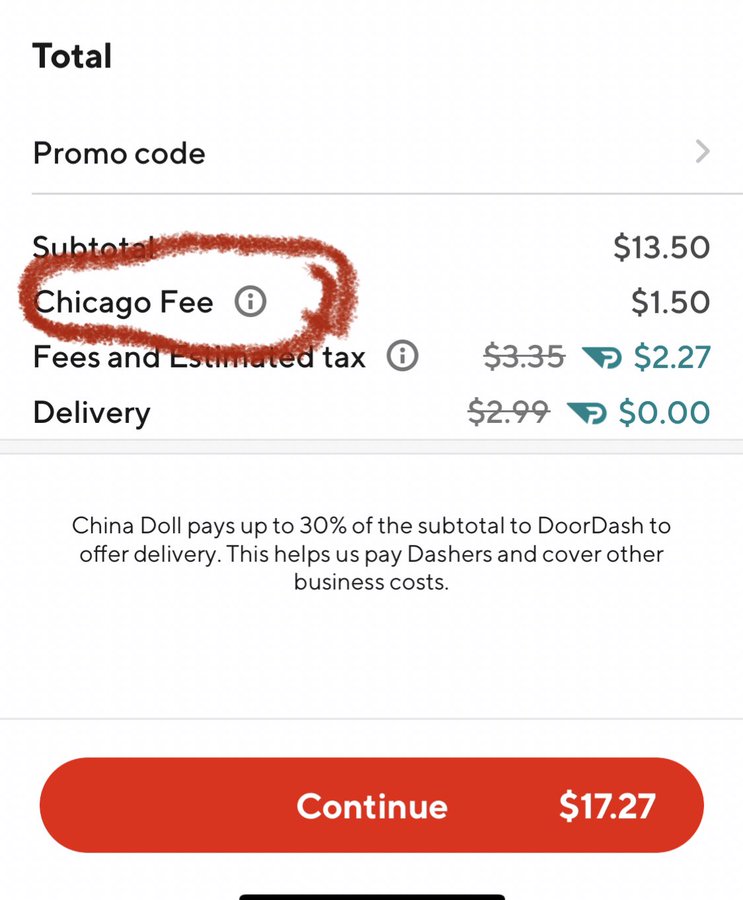

New Doordash Fees In Nearly A Dozen Markets Frustrate Diners Officials

As a sole proprietor profit determines an independent contractors taxable income.

. Pin On Income. DoorDash currently sends their. There isnt really a category of taxes for DoorDash but we know that a lot of Dashers refer to their tax responsibilities as DoorDash taxes so weve used that term now and again.

Its just our version of employment. A peer-to-peer sale may be considered to be a disposition of personal-use property. That makes it important to understand the DoorDash tax rules.

A DoorDash Merchant for example would receive a 1099-K from DoorDash as DoorDash has concluded it satisfies the criteria for a TPSO. Instead you must pay them yourself at. You will simply need your 1099-NEC form which as stated earlier DoorDash will usually automatically send to you well in advance of tax filing time.

Let the team at HR Block walk you through how taxes work for DoorDash independent contractors. As such DoorDash doesnt withhold the taxes for you. Self-Employment tax is not an extra tax for the self-employed.

One of the benefits of being an independent contractor is that. It also includes your income. DoorDash drivers are self-employed rather than employees.

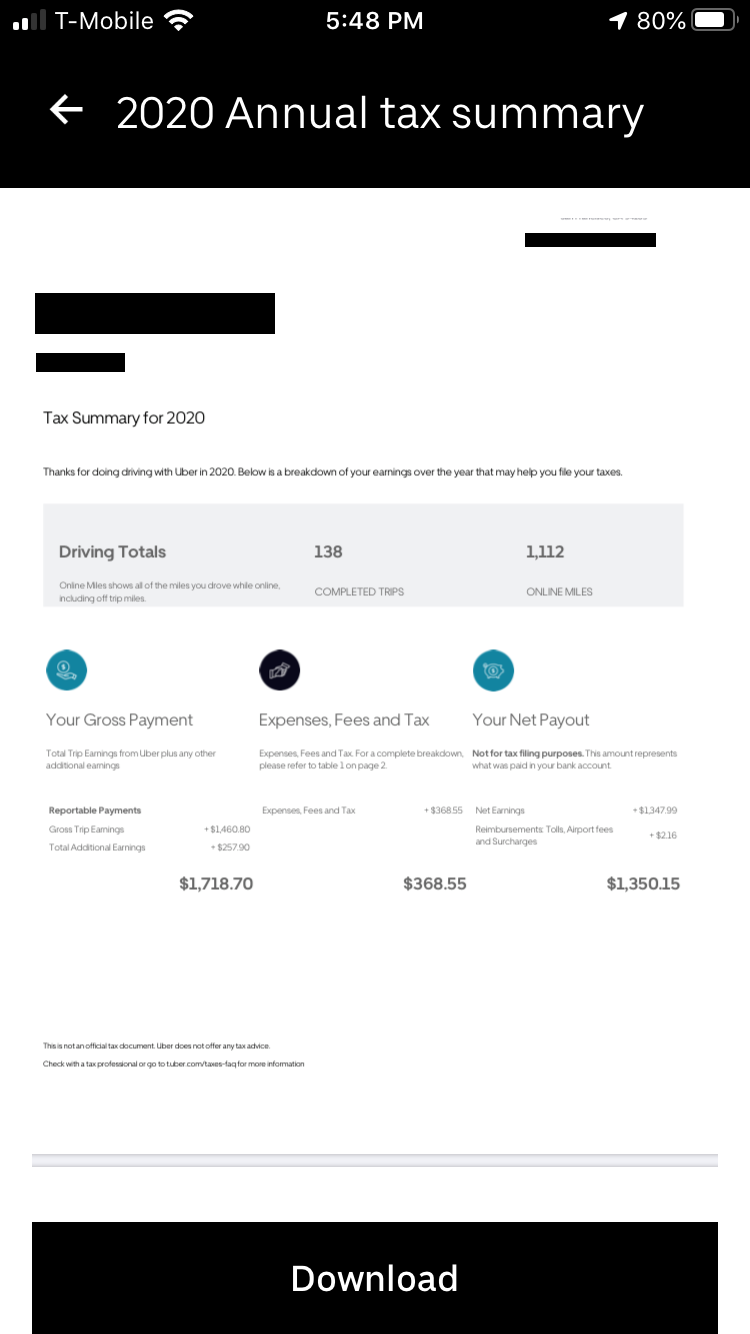

This includes 153 in self-employment taxes for Social Security and Medicare. The gross earnings from DoorDash will be listed on tax form 1099-NEC also known as a 1099 as nonemployee compensation and Dashers can deduct business expenses. The Doordash Taxes series provides an overview of how taxes work for.

Doordash only sends 1099 forms to dashers who made 600 or more in 2021. Independent contractors still owe these taxes but are considered self-employed. This is the part of Doordash taxes that can really throw people off.

In keeping with our beliefs and goals no employee or applicant will face discrimination or harassment based on. Gross earnings from DoorDash will be listed on tax form 1099-NEC also just called a 1099 as nonemployee compensation. Federal mileage reimbursement of 56 cents per mile includes the.

That means that you deduct Doordash expenses on IRS form Schedule C as a means of. That said here are three basic things that help you understand how your Doordash earnings will impact your taxes alongside of course any other earnings from other gigs. Is Doordash Pay Considered Income or Profit.

This is the reported income a Dasher will use to file. What expenses can I write off. A 1099-NEC form summarizes Dashers earnings as independent contractors in the US.

Race color ancestry national origin religion. DoorDash drivers can write off expenses such as gasoline only if they take actual expenses as a deduction. Its provided to you and the IRS as well as some US states if you earn 600 or more in.

Expect to pay at least a 25 tax rate on your DoorDash income. Independent contractors for Doordash Uber Eats Grubhub Instacart and other gig companies can usually take 20 off their taxable. The first is your standard federal income tax.

Employee food-delivery drivers often spend their own money on the job so you might be able to deduct certain work-related costs at tax time including. With this method you deduct a certain amount 0. The seller would also need to meet the minimum.

Which Food Delivery App Should You Use To Order Your Burger By Reynolds Sandbox The Reynolds Sandbox Medium

Tips For Filing Doordash Taxes Silver Tax Group

Does Doordash Track Mileage What Delivery Drivers Need To Know

Doordash Vs Uber Eats Which App Is Better For Drivers

How To Become A Doordash Driver Dasher Pay What To Expect Review

Doordash Taxes Made Easy Ultimate Dasher S Guide Ageras

Self Employment Taxes A Guide For Food Delivery Drivers

Doordash Driver Pay Per Hour Week Month Expenses More

Do 1099 Delivery Drivers Need To Pay Quarterly Taxes Entrecourier

How To Become A Doordash Driver Requirements Application Ridester Com

Taxes Write Offs Expenses With Skip The Dishes Doordash Youtube

How Do Food Delivery Couriers Pay Taxes Get It Back

Does Doordash Take Out Taxes Ducktrapmotel

Doordash Taxes Made Easy Ultimate Dasher S Guide Ageras

National Doordash Driver Forum Tax Question For Dashers Who Delivered For All Or Most Of Last Year

Complete Guide To 1099 Doordash Taxes In Plain English 2022