flow through entity private equity

The baseline structure would involve the private equity buyer acquiring both the flow-through and blocked portions of the investments under a single aggregating vehicle taxed as a partnership for. An entity taxed as a flow-through will generally have greater value because of the significant tax benefits and that can be afforded the purchaser than for.

Model Portfolio Subscription Model Portfolio Investing Cash Flow Statement

ASC 740 contains minimal explicit guidance on the accounting for deferred taxes associated with investments in partnerships or other flow-through entities eg LLCs.

. We believe that deferred taxes related to an investment in a foreign or domestic partnership and other flow-through entities that are taxed as partnerships such as multi-member LLCs should be based. The team of individuals that will identify execute and manage investments in privately-held operating businesses. A purchaser will still obtain a basis step-up in the context of the purchase of 100 of the entity equity interests.

Most of the income of most private equity and venture capital funds will consist of gains from the sale of portfolio. Planning devices can include the following. In addition the non-US.

Hence the income of the entity is the same at the income of the owners or investors. Trade or business flow-through operating entities. Through this arrangement business owners and shareholders only pay taxes on their personal income generated through this business and dont have to pay additional corporate taxes for running.

Private equity and hedge funds are generally structured as pass-through entities allowing them to pass their entire tax obligation along. Corporation a so-called Blocker which insulates such investors from the direct obligation to pay US. We dont know how the new tables are going to look but based on the current tables a 25 rate would be favorable at single income of 91901 and married joint of 153101 but it really doesnt.

Investor generally will not. The limited partners will be the institutional and individual investors. In this legal entity income flows through to the owners of the entity or investors as the case may be.

Flow-through entities are also known as pass-through entities or fiscally-transparent entities. That is the income of the entity is treated as the income of the investors or owners. Deloitte specialists in flow-through and partnership tax compliance can help you understand and evaluate the tax-rate reductions incentives and thresholds applicable to your current business and compare whether a flow-through partnership or S corporation S corp structure is still the right approach to meeting your business goals.

A private equity or hedge fund located in the United States will typically be structured as a limited partnership due to the lack of an entity-level tax on partnerships and other flow-through entities under the US. One element of a deal that can further complicate them is the structure of the sponsors General Partner GP co-investment relative to its limited partners LPs investments. For instance an individual in a 50 tax bracket who invests 20000 in a flow-through offering is really only risking 10000 since he receives 10000.

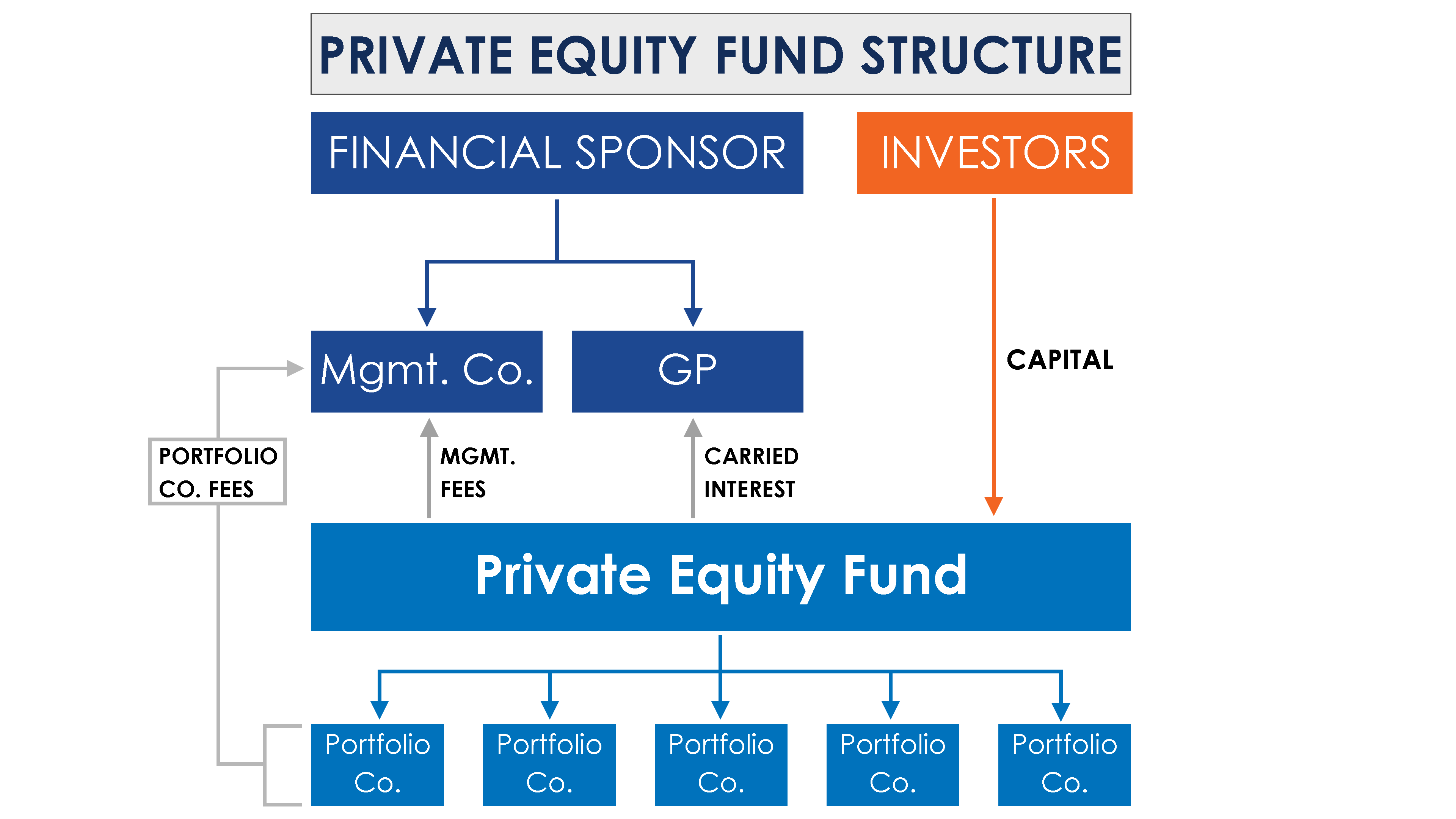

Real Estate Capital Markets REITs. 1 Financial Sponsor Sponsor in image. Waterfall structures in commercial real estate private equity deals can be complex.

States real property interests USRPIs or interests in flow-through entities themselves engaged in a US. Tax exempts and non-US. A private equity fund or other investor in purchasing a corporation may wish to establish an LLC or other pass-through entity as a holding vehicle permitting flexible economics a control vehicle and the ability to grant profits interests as a compensation incentive discussed below.

This is generally comprised of a General. In an earlier article titled Rollover Equity Transactions 2019 we discussed the various business and tax issues associated with transactions involving private equity PE buyers who include rollovers of target owner equity in their leveraged buyout LBO transactionsHere we take a deeper dive into the ramifications of having some PE investors invest in target. Typical features of the general partner in a basic private equity structure Usually a US or flow through entity in which the participants include - Principals - Can be an investment bank or other financial institution provide services as employees Features of the management company a US or flow through entity Participants.

It is typical in private equity funds for certain tax-sensitive investors including US. Investors such as sovereign wealth funds to own their indirect interests in certain types of fund investments through an entity taxable as a US. LPs can easily misinterpret cash flow splits and profit split.

Common types of FTEs are general partnerships limited partnerships and limited liability. A flow-through entity FTE is a legal entity where income flows through to investors or owners. Raising a private equity fund requires two groups of people.

A flow-through entity is a business entity is which income of the entity passes on to the investors or owners of the entity. 2 LPs and LLCs are pass-through entities for federal income tax purposes. A pass-through entity is a business structure in which the taxes on the generated business revenue are directly passed on to the owners to avoid double taxation.

Flow-through shares significantly reduce the risk of investing in resource stocks by allowing investors to recover a substantial portion of their original investment through income tax savings. Ian Formigle Posted August 23 2017.

Pin En Sg Company Incorporation

Pin On Doing Business In Singapore

Company Registration In India Private Limited Company Business Advisor Limited Company

Cryptocurrancy Decentralized Finance Finance Fun Facts Fintech

What Is Decentralized Autonomous Organization Dao In A Nutshell Fourweekmba Organizational Structure Types Of Organisation Organization

Leveraged Recapitalization Meaning Pros Cons And More In 2022 Corporate Strategy Financial Management Leverage

How To Start An Llc In Nevada Llc Business Annual Report Estate Planning Attorney

Coefficient Of Variation Money Management Advice Accounting Education Financial Management

Private Equity Fund Structure A Simple Model

Stock Talk New Brand Names For The New Decade 2020 30 Movie Market Brand Names Jet Airways

Private Equity Fund Structure A Simple Model

Pin On Journal Spreads And Notes

Market Risk Premium Market Risk Financial Management Investing

Model Portfolio Subscription Model Portfolio Investing Cash Flow Statement

How To Get Approved By Private Label M A P And Exclusive Dropshipping Suppliers Keep In Mind Dropshipping Suppliers Trust Yourself Internet Marketing

How To Start A Poultry Farm In Uae Poultry Farm Poultry Farm

Register Your One Person Company Registration In Kolkata Sole Proprietorship Public Limited Company Company

Annual Compliance Section 8 Company For Non Profit Organization Company Nonprofit Organization Non Profit